https://www.kitcomm.com/showthread.php?t=19066

Fortis is a large bank and insurer in the Netherlands and Belgium. It took over ABN Amro last year, together with RBS and another bank. Last Thursday, its share lost 17% because Fortis attracted foreign capital.

I was shocked when I read the following, which was brought out 4hours ago:

American ‘meltdown’ reason for money injection Fortis.

28th of June, 9:10

BRUSSELS/AMSTERDAM - Fortis expects a complete collapse of the US financial markets within a few days to weeks. That explains, according to Fortis, the series of interventions of last Thursday to retrieve € 8 billion. « We have been saved just in time. The situation in the US is much worse than we thought », says Fortis chairman Maurice Lippens. Fortis expects bankruptcies amongst 6000 American banks which have a small coverage currently. But also Citigroup, General Motors, there is starting a complete meltdown in the US »

This fits in the picture, with the other press releases last week, like the short advise of Goldman Sachs and some other of the same messages last week.

Although gold has rallied a lot lost week: first thing monday morning: short Dow, long Gold?

Or will there be a rate cut, which undermines (delays) everything?

Original press release:

VOTRON BLIJFT AAN NA GOLF VAN KRITIEK

Amerikaanse ’meltdown’ reden geldinjectie Fortis

28 Jun 08, 09:10

BRUSSEL/AMSTERDAM (DFT) - Fortis rekent binnen enkele dagen tot weken op het volledig instorten van de Amerikaanse financiële markten. Dat verklaart volgens de bankverzekeraar de serie ingrepen van donderdag om zich met €8 miljard te versterken. „We zijn op het nippertje gereed. Het gaat in de Verenigde Staten veel slechter dan gedacht”, zegt Fortis-chairman Maurice Lippens, die volhoudt dat topman Votron aanblijft. Fortis verwacht faillissementen onder 6000 Amerikaanse banken die nu weinig dekking hebben. „Maar ook Citigroup, General Motors, er begint een complete meltdown in de VS.”

http://www.dft.nl/bedrijven/fortis/4...ie_Fortis.html

In Gold We Trust

Reply With Quote

VOTRON TO REMAIN AFTER WAVE OF CRITICISM

U.S. ‘meltdown’ reason geldinjectie Fortis

June 28 08, 09:10

BRUSSELS / AMSTERDAM (DFT) - Fortis expects within the next few days to weeks to complete the collapse of the U.S. financial markets. That explains the bank insurers interventions of the series Thursday at dealing with € 8 billion. « We are ready at the last minute. It goes in the United States much worse than thought, « said Fortis chairman Maurice Lippens, who maintains that CEO Votron to live. Fortis expects bankruptcies of 6000 U.S. banks that now lack coverage. « But Citigroup, General Motors, there begins a complete meltdown in the U.S.. »

Fortis took yesterday € 1.5 billion with a share issue. At the end of last year was the Belgian-Dutch group € 13 billion of new shares for the takeover of ABN Amro, for which it paid € 24 billion. Lippens bases its concern on interviews with bankers. « Two months ago we knew not so bad that it is in America. And it will be much worse. We have a thick mattress needed for the next eighteen months to come when we can bring to ABN Amro. «

Two weeks ago reported the U.S. investment bank and adviser to Fortis Merrill Lynch certainly € 6.2 billion in additional capital was needed. The VEB yesterday demanded clarification of Fortis: CEO Jean-Paul Votron stopped in late april Fortis maintains that after the purchase of ABN Amro does not need on the capital market. In one year € 30 billion in market capitalization destroyed. After Votron last confession kelderde the share price by 19.4%, although yesterday climbed by 4.4% to € 10.65.

The massive unrest around the bank insurers, especially with our neighbours in Belgium as a bomb broken. While the fuss arose in the Netherlands to the limited financial world, it is with our neighbours the call of the day. Not only is the bank dominates the streetscape, but by the mokerslag for the Belgian volksaandeel are also hundreds of thousands of small investors hit hard.

All Belgian newspapers opened yesterday with real rampenkoppen, where the free fall of the bank insurers was wide coverage. ‘Fortis crashes, « » Rampdag for Fortis’ and’ Fortis loses 5.3 billion, « opened three leading newspapers.

The panic around the group across the border so great that the national regulator CFBA has had reassuring words to speak to the desperate savers. « The emergency of Fortis is no reason to bank run and money to get off, » said a CFBAwoordvoerder. « The bank complies with all legal requirements, but has itself just very sharp targets. »

Maurice Lippens claims that all major shareholders yesterday « unanimously support » have pledged.

Like arrows in the Netherlands focus mainly on CEO Jean-Paul Votron, who are heavily vertild appears to have complied with the takeover of ABN Amro. But while the Netherlands in Brussels calling his bonus of € 2.5 million to be paid back in Belgium is demanding his departure.

Who makes such big mistakes, must bear the consequences and therefore resign, « said Huybregtse chairman of the Flemish federation of Investment and Investors. The fall of the share is for him a confirmation that the takeover of ABN Amro far too expensive and was poorly timed.

« The former shareholders of ABN Amro are now taking a bath in champagne », stressed Huybrechts. « Who makes major mistakes, must go. Fortis is a really volksaandeel and with confidence that you can not cope reckless. «

The Belgian newspaper the Standard is tough on the CEO: « The kredietcrisis has affected all banks, but it is no excuse. Fortis is much sharper fall, « says the commentator. « Fortis has always denied that there was still a capital increase. They were therefore either lies or ignorance. Both are equally bad, so must Votron the honour to itself. He is the only one who has earned something to the whole operation. «

According to Belgian media wanted Fortis announce Thursday that the bonus Votron would be removed, but this is at the last moment not yet happened. Also, all press speculation about his succession, with the name of Filip Dierckx.

Votron itself will of being firm. « The shareholders are behind me and also in the top of the group, I only support for this I have put in operation, » said the under fire lying Fortis chief executive.

The refund of the now controversial bonus points he resolutely. « What I do with my money, my case. The bonus had nothing to do with ABN Amro, but was about the year 2007, « said Votron. The CEO is a willing part of his salary in Fortis documents.

Votron may also still rely entirely on chairman Lippens, who denies that the bank itself on the takeover of ABN Amro has completed. « Votron remains simply the CEO. At present intervention, which is difficult, that’s really show leadership. «

Fortis is a large bank and insurer in the Netherlands and Belgium. It took over ABN Amro last year, together with RBS and another bank. Last Thursday, its share lost 17% because Fortis attracted foreign capital.

I was shocked when I read the following, which was brought out 4hours ago:

American ‘meltdown’ reason for money injection Fortis.

28th of June, 9:10

BRUSSELS/AMSTERDAM - Fortis expects a complete collapse of the US financial markets within a few days to weeks. That explains, according to Fortis, the series of interventions of last Thursday to retrieve € 8 billion. « We have been saved just in time. The situation in the US is much worse than we thought », says Fortis chairman Maurice Lippens. Fortis expects bankruptcies amongst 6000 American banks which have a small coverage currently. But also Citigroup, General Motors, there is starting a complete meltdown in the US »

This fits in the picture, with the other press releases last week, like the short advise of Goldman Sachs and some other of the same messages last week.

Although gold has rallied a lot lost week: first thing monday morning: short Dow, long Gold?

Or will there be a rate cut, which undermines (delays) everything?

Original press release:

VOTRON BLIJFT AAN NA GOLF VAN KRITIEK

Amerikaanse ’meltdown’ reden geldinjectie Fortis

28 Jun 08, 09:10

BRUSSEL/AMSTERDAM (DFT) - Fortis rekent binnen enkele dagen tot weken op het volledig instorten van de Amerikaanse financiële markten. Dat verklaart volgens de bankverzekeraar de serie ingrepen van donderdag om zich met €8 miljard te versterken. „We zijn op het nippertje gereed. Het gaat in de Verenigde Staten veel slechter dan gedacht”, zegt Fortis-chairman Maurice Lippens, die volhoudt dat topman Votron aanblijft. Fortis verwacht faillissementen onder 6000 Amerikaanse banken die nu weinig dekking hebben. „Maar ook Citigroup, General Motors, er begint een complete meltdown in de VS.”

http://www.dft.nl/bedrijven/fortis/4...ie_Fortis.html

In Gold We Trust

Reply With Quote

VOTRON TO REMAIN AFTER WAVE OF CRITICISM

U.S. ‘meltdown’ reason geldinjectie Fortis

June 28 08, 09:10

BRUSSELS / AMSTERDAM (DFT) - Fortis expects within the next few days to weeks to complete the collapse of the U.S. financial markets. That explains the bank insurers interventions of the series Thursday at dealing with € 8 billion. « We are ready at the last minute. It goes in the United States much worse than thought, « said Fortis chairman Maurice Lippens, who maintains that CEO Votron to live. Fortis expects bankruptcies of 6000 U.S. banks that now lack coverage. « But Citigroup, General Motors, there begins a complete meltdown in the U.S.. »

Fortis took yesterday € 1.5 billion with a share issue. At the end of last year was the Belgian-Dutch group € 13 billion of new shares for the takeover of ABN Amro, for which it paid € 24 billion. Lippens bases its concern on interviews with bankers. « Two months ago we knew not so bad that it is in America. And it will be much worse. We have a thick mattress needed for the next eighteen months to come when we can bring to ABN Amro. «

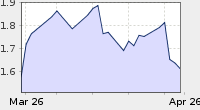

Two weeks ago reported the U.S. investment bank and adviser to Fortis Merrill Lynch certainly € 6.2 billion in additional capital was needed. The VEB yesterday demanded clarification of Fortis: CEO Jean-Paul Votron stopped in late april Fortis maintains that after the purchase of ABN Amro does not need on the capital market. In one year € 30 billion in market capitalization destroyed. After Votron last confession kelderde the share price by 19.4%, although yesterday climbed by 4.4% to € 10.65.

The massive unrest around the bank insurers, especially with our neighbours in Belgium as a bomb broken. While the fuss arose in the Netherlands to the limited financial world, it is with our neighbours the call of the day. Not only is the bank dominates the streetscape, but by the mokerslag for the Belgian volksaandeel are also hundreds of thousands of small investors hit hard.

All Belgian newspapers opened yesterday with real rampenkoppen, where the free fall of the bank insurers was wide coverage. ‘Fortis crashes, « » Rampdag for Fortis’ and’ Fortis loses 5.3 billion, « opened three leading newspapers.

The panic around the group across the border so great that the national regulator CFBA has had reassuring words to speak to the desperate savers. « The emergency of Fortis is no reason to bank run and money to get off, » said a CFBAwoordvoerder. « The bank complies with all legal requirements, but has itself just very sharp targets. »

Maurice Lippens claims that all major shareholders yesterday « unanimously support » have pledged.

Like arrows in the Netherlands focus mainly on CEO Jean-Paul Votron, who are heavily vertild appears to have complied with the takeover of ABN Amro. But while the Netherlands in Brussels calling his bonus of € 2.5 million to be paid back in Belgium is demanding his departure.

Who makes such big mistakes, must bear the consequences and therefore resign, « said Huybregtse chairman of the Flemish federation of Investment and Investors. The fall of the share is for him a confirmation that the takeover of ABN Amro far too expensive and was poorly timed.

« The former shareholders of ABN Amro are now taking a bath in champagne », stressed Huybrechts. « Who makes major mistakes, must go. Fortis is a really volksaandeel and with confidence that you can not cope reckless. «

The Belgian newspaper the Standard is tough on the CEO: « The kredietcrisis has affected all banks, but it is no excuse. Fortis is much sharper fall, « says the commentator. « Fortis has always denied that there was still a capital increase. They were therefore either lies or ignorance. Both are equally bad, so must Votron the honour to itself. He is the only one who has earned something to the whole operation. «

According to Belgian media wanted Fortis announce Thursday that the bonus Votron would be removed, but this is at the last moment not yet happened. Also, all press speculation about his succession, with the name of Filip Dierckx.

Votron itself will of being firm. « The shareholders are behind me and also in the top of the group, I only support for this I have put in operation, » said the under fire lying Fortis chief executive.

The refund of the now controversial bonus points he resolutely. « What I do with my money, my case. The bonus had nothing to do with ABN Amro, but was about the year 2007, « said Votron. The CEO is a willing part of his salary in Fortis documents.

Votron may also still rely entirely on chairman Lippens, who denies that the bank itself on the takeover of ABN Amro has completed. « Votron remains simply the CEO. At present intervention, which is difficult, that’s really show leadership. «

No comments:

Post a Comment